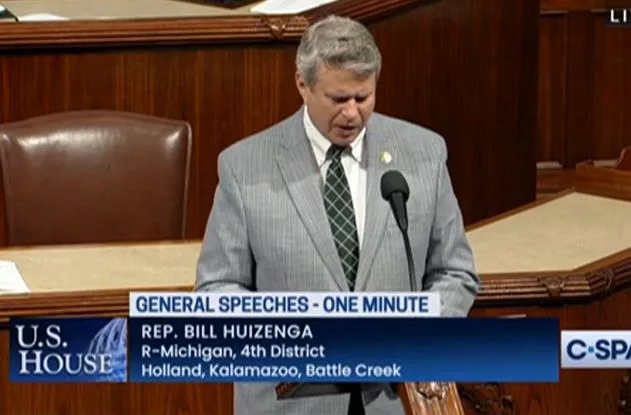

Congressman Bill Huizenga is part of an effort to revamp some rules of the Securities and Exchange Commission. He tells us the Republican Environmental, Social, and Governance Working Group, or ESG, has compiled an interim report on SEC reporting rules. They’re looking to stop the SEC from requiring filings that are not relevant to the disclosing business.

“There’s been a lot of action from the Securities and Exchange Commission and others that are regulators of business here in the United States that have been forcing decisions that are not based on business decisions or materiality, meaning the relevance to their business operation, and it’s been really more about social engineering,” Huizenga said.

For example, Huizenga says a company that is not in the energy business shouldn’t have to report carbon emissions. He’s introduced the Mandatory Materiality Requirement Act, which amends the Securities Act of 1933 and the Securities Exchange Act of 1934 by inserting language saying an “issuer is only required to disclose information in response to disclosure obligation adopted by the Commission to the extent the issuer has determined that such information is important with respect to a voting or investment decision regarding such issuer.” Huizenga says the Biden administration is making the SEC political. The ESG’s report outlines several potential reforms.